Restoring credit takes time. From getting and reviewing credit reports, drafting and sending dispute letters, to submitting required files by credit bureaus. Fortunately, we can now automate all these time-consuming processes. With the right and fast credit repair software, you can save up to 90% of your valuable time in repairing credit.

A big part of restoring credit is identifying errors in credit reports. This process can take up to one to three hours if you are not using fast credit repair software. The process includes downloading credit reports from the three credit bureaus. Namely: Equifax, Experian, and TransUnion. Then meticulously review and compare each report to identify any inaccuracies or mistakes.

The importance of getting credit reports from different bureaus

Getting credit reports from the three major credit bureaus is crucial to identify discrepancies. Believe it or not, errors in credit reports are very common. In fact, according to an FTC study, one in five consumers find errors in at least one of their credit reports, which leads them to have a low credit score. So, if you wish to improve your credit score or provide efficient credit repair services to clients, it is crucial to review credit reports carefully.

How long does it take to write dispute letters?

After identifying errors in credit reports, it is time to draft dispute letters to creditors or credit bureaus. You can complete this process within an hour to a few days. The length of time to finish this process depends on the number and types of errors found in the reports. Discrepancies in credit reports can range from simple typographical errors to instances where the debt has already been paid or belonged to someone else.

How many disputes should you send to credit bureaus?

The number of dispute letters you should send to credit bureaus depends on the specific errors or inaccuracies you need to address in your credit report. In general, it is recommended to send a separate dispute letter for each distinct error you wish to dispute. This ensures clarity and focus in addressing each issue individually.

For example, if you have identified three different errors on your credit report, it would be ideal to send three separate dispute letters, each specifically addressing one error. This approach allows credit bureaus to handle and investigate each dispute independently, increasing the chances of a thorough examination and resolution.

Remember to include all necessary documentation and evidence to support your claim in each dispute letter. Be concise, clear, and professional in your communication, providing a detailed explanation of the error and any relevant supporting documentation.

Needless to say, writing dispute letters is a difficult and time-consuming task. Fortunately, this process can be automated using credit repair software.

Once the dispute letters are sent, it may take up to 30 days for the bureaus to reply. So it’s critical to attach all the necessary documents to prove your case in filing a dispute. This step will help the credit agency easily verify your dispute.

What if the credit bureaus does not reply in 30 days? Here’s what you need to do.

How to Make Credit Repair Process Fast

Manually doing the credit repair processes is indeed time-consuming, confusing, and difficult. Fortunately, there’s a solution that automates and simplifies the credit repair process, ensuring speed, ease, and accuracy.

Introducing the remarkable fast credit repair software – Credit Money Machine (CMM). Renowned as the industry’s fastest and most advanced credit repair software. CMM revolutionizes the credit restoration journey.

Here’s why CMM stands out from the rest:

Why the Credit Money Machine is the Fastest Credit Repair Software?

1. It is the most automated credit repair software.

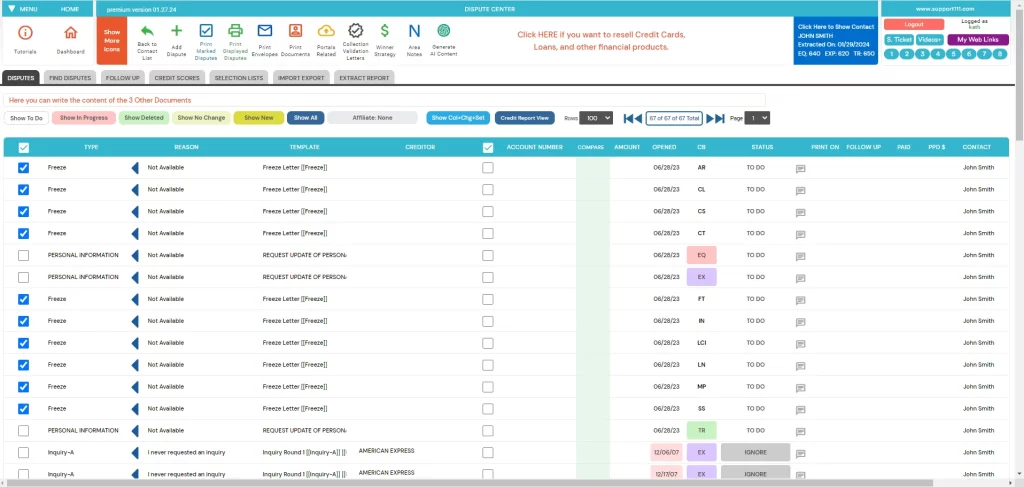

The Credit Money Machine Software allows you to get full credit reports from the three major bureaus for the last two years in just one click. Then with remarkable efficiency, the program detects and marks all the errors. In addition, the credit reports from Equifax, Experian, and TransUnion are placed side by side, allowing you to compare the results easily.

2. It has letter templates to help you generate dispute letters within seconds.

It automatically extracts derogatory items and assigns dispute letters and reasons simultaneously. In addition, the latest software version has an Ai text generator that allows you to create unique letters instantly. In case you want to create your own, than using the built-in templates.

3. This fast credit repair software detects and marks documents that must be attached.

This innovative software excels at identifying the documents that must be attached to the dispute letter. Credit Money Machine efficiently scans your letter, automatically detecting the necessary document to be attached and marking the letter when it lacks an important attachment. This software streamlines the often challenging task of manually searching for the necessary document to attach. Thus, saving you valuable time and ensuring you provide all the important documents that will help prove your case.

Here’s a short video of Credit Money Machine showing how to process a client in less than 10 seconds.

This ultimately fast credit repair software offers four versatile versions specifically designed to cater to your unique needs. So whether you’re an individual seeking to restore your personal credit or a credit repair business looking to serve your clients efficiently, we have the perfect solution for you.

Our user-friendly interface and advanced features allow you to streamline the credit repair process, save 90% of your time, and maximize results.

If you are running a credit repair business or planning to start this journey, we have the best software for you. Our fast business credit repair software is integrated with CRM, a sales program, and a marketing program, allowing you to do everything in one software.

Unlock the potential of the Credit Money Machine

Start building a stronger credit for you or for your clients. Start now and experience the difference for yourself!

Alternatively, you can book a Live DEMO for free to see our powerful software in action.

For credit repair business start-ups, I recommend learning about credit repair laws to avoid legal issues and a guide on how to start credit repair business.