Credit Repair Laws in Texas

Familiarize yourself with the credit repair laws in Texas while also exploring interesting facts about the state. This article will provide valuable insights into credit repair laws in Texas. To help consumers know their rights and aspiring credit repair specialist ensure their business operates within legal boundaries and remains competitive in the market.

Starting a credit repair business in Texas presents a lucrative opportunity as the state is one of the USA’s wealthiest and most populous states. (Along with California, Florida, and New York). However, like any business venture, success requires following the right practices and decision-making.

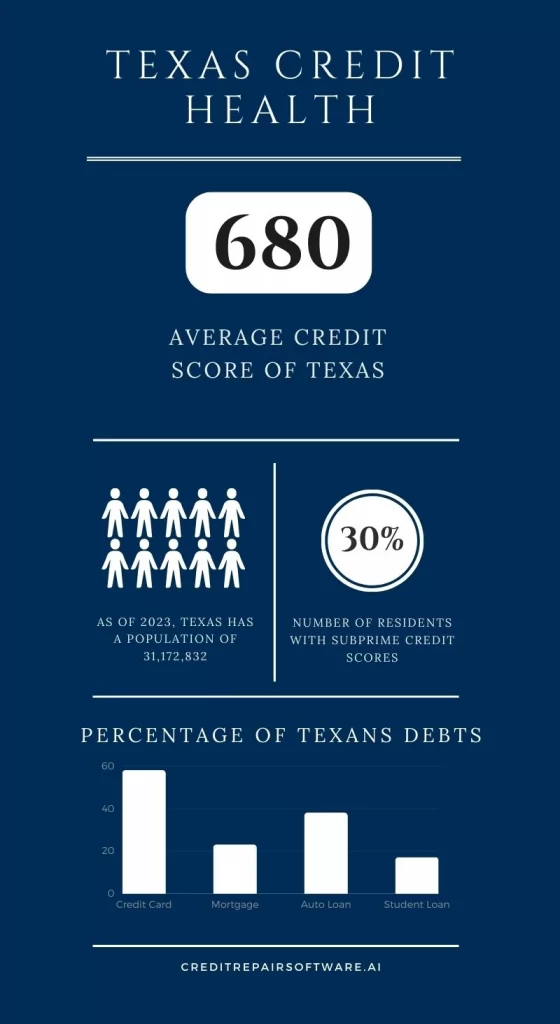

Texas Credit Health

Texas boasts a population of approximately 29.9 million people and a staggering GDP of $1,772,132,000. With 6.32% of the entire country’s millionaires residing in Texas, it’s evident that many Texans rely on credit to meet their financial needs and desires. Around 58% of the population carries credit card debt, 38% have auto loans, 23% have mortgage debts, and 17% hold student loans.

Texas boasts a population of approximately 29.9 million people and a staggering GDP of $1,772,132,000. With 6.32% of the entire country’s millionaires residing in Texas, it’s evident that many Texans rely on credit to meet their financial needs and desires. Around 58% of the population carries credit card debt, 38% have auto loans, 23% have mortgage debts, and 17% hold student loans.

While the state’s average credit score is 680, a significant % of the population, 30%, possesses subprime credit scores. This highlights the pressing need for credit repair services, making credit repair businesses highly sought-after and in demand in Texas. However, to ensure your business thrives, it’s essential to understand the credit repair laws in Texas. Let’s delve into key aspects you should be aware of.

Familiarize Yourself with Texas Credit Repair Laws: Prohibited Acts, Disclosure Statement, Terms of Contract, and Cancellation of Contract

Prohibited Acts under Texas Credit Repair Laws

1. No upfront payment: A credit repair company or its representative cannot receive any payment until they have completed the services unless they possess a surety bond.

2. No payment for referrals: It is illegal for a credit repair company or its agent to receive payment for referring consumers to creditors offering credit on the same terms available to the general public.

3. No misleading statements: Credit repair service providers shall not make any false or misleading representations, such as guaranteeing the removal of bad credit. They also cannot guarantee credit extension regardless of a person’s credit history.

4. No misleading credit reporting: Credit repair businesses cannot make untrue or misleading statements about a consumer’s creditworthiness, credit capacity, or credit standing to consumer reporting agencies or creditors.

Texas Credit Repair Laws Disclosure Statement

Before commencing any services, credit repair companies must provide consumers with a disclosure statement containing the following information:

1. Detailed description and total cost of the services to be performed.

2. Consumer’s right to proceed against the surety bond, including the name and address of the surety company issuing the bond.

3. Consumer’s right to review information in their file maintained by a consumer reporting agency.

4. Availability of free review of consumer file information within 30 days of receiving notice of credit denial.

5. Consumer’s right to dispute completeness or accuracy of items in their file directly with a consumer reporting agency.

6. The inability to permanently remove accurate information from consumer reporting agency files.

7. Explanation of when consumer information becomes obsolete and the prohibition on reporting obsolete information.

8. Availability of nonprofit credit counseling services.

9. The credit repair company must retain a copy of the document, signed by the consumer, for two years.

Forms and Terms of Contract

To ensure transparency and legal compliance, the credit repair company and consumer must have a written contract containing the following information:

1. The consumer must make a Total payment to the credit repair business or its specialist.

2. Detailed description of the services to be performed, including a promise of a full or partial refund if services are not completed within 180 days.

3. Name, address, and contact information of the business and its agent responsible for providing credit repair services.

For a thorough information about contract including a full copy of consumer rights under federal law, read here.

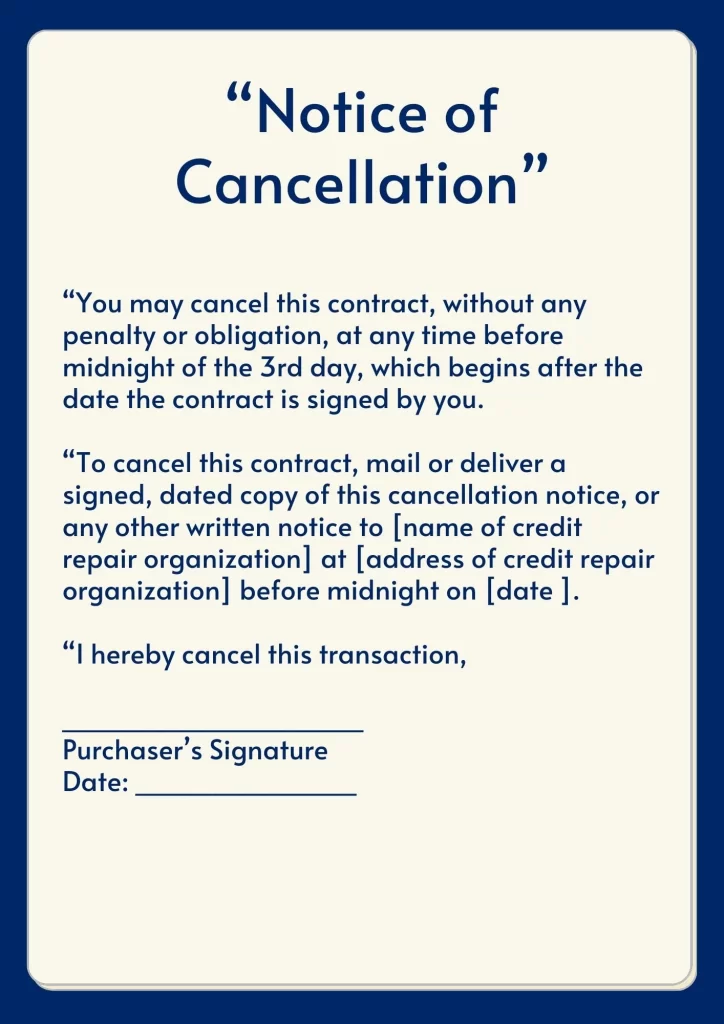

Cancellation of Contract under Texas Credit Repair Laws

The contract must include a statement, written in bold, capitalized, or underlined text near the space for the consumer’s signature, stating:

“YOU, THE BUYER, MAY CANCEL THIS CONTRACT AT ANY TIME BEFORE MIDNIGHT OF THE THIRD DAY AFTER THE DATE OF THE TRANSACTION. SEE THE ATTACHED NOTICE OF CANCELLATION FORM FOR AN EXPLANATION OF THIS RIGHT.”

Additionally, the contract should have two easily detachable copies of the cancellation notice. The notice must be in boldfaced type and include the following form:

**Disclaimer: While we strive to provide accurate information on Texas credit repair laws, please note that government laws are subject to change. For the most up-to-date information, refer to the Credit Services Organization Act of Texas.**

Now that you have gained insights into credit repair laws in Texas, it’s essential to understand the steps for starting a credit repair business in the state.

How to Start a Credit Repair Business in Texas:

1. Obtain a surety bond: Texas requires all credit repair businesses to obtain a $10,000 surety bond from a reputable surety company.

2. Register your business: Before conducting business in Texas, you must file a registration with the Secretary of State office.

3. Invest in computer software: Streamline your business processes, minimize errors, and improve efficiency by investing in essential software such as CRM, autoresponder, invoicing systems, and email management. We recommend All-in-One credit repair software for businesses, saving you time and money compared to purchasing multiple programs.

By adhering to Texas credit repair laws and following these essential steps, you’ll position your credit repair business for success in the thriving Texas market.

PLANNING TO START OR EXPAND A CREDIT REPAIR BUSINESS?

Experience processing a client in less than 15 seconds with Credit Money Machine. It is the fastest credit repair software in the industry and the only software for fixing credit with CRM integrated, Sales program, Marketing program, and Credit Repair program with all areas working together to catapult the credit repair business to new heights.

We have 3 credit repair software for business to ensure you get what you need.

Alternatively, you can SCHEDULE A FREE LIVE PRESENTATION to see Credit Money Machine in action.

Read Credit Repair Laws in All States or navigate the map to read credit repair laws in other states.