Credit Repair Laws in South Carolina

Building a credit repair business in South Carolina requires a solid understanding of the industry. Particularly the credit repair laws in South Carolina. With a population of approximately 5.4 million residents and a poverty rate of 13.92%, South Carolina faces its share of credit challenges.

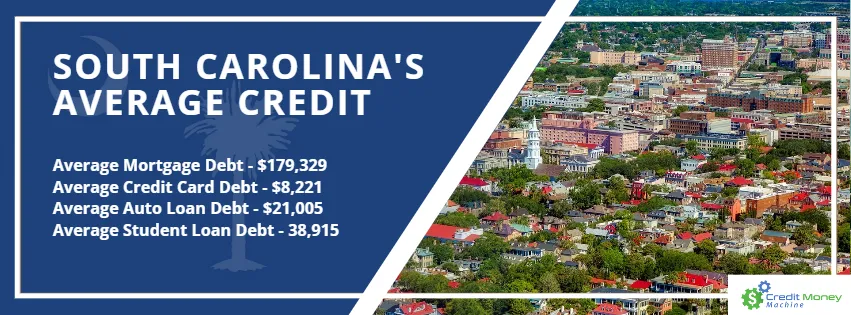

Carolina’s Credit Health

The state has an average credit score of 678. This is 38 points lower than the national average of 716. Unfortunately, according to the South Carolina Department of Consumer Affairs, there is an increase in consumer debt in the state. As indicated in the state’s credit report, the average consumer debt in South Carolina rose to $27,017 in 2022 from $15,813 in 2019.

Regarding specific debt categories, South Carolina’s average mortgage debt is $179,329. The average credit card debt is $8,221. While the average car debt is $21,005. Moreover, the state’s average student loan debt is $38,915. The state ranks 15th highest in credit card debt and 5th highest in student debt in 2022.

Clearly, these statistics highlight the pressing need for credit repair services in South Carolina. Many residents seek assistance in improving their credit profiles to overcome loan denials.

How to Build a Credit Repair Business in South Carolina?

To establish a credit repair business in South Carolina, complying with the state’s rules and regulations is crucial. Credit repair is legal in South Carolina, but obtaining a license permit from the State’s Department of Consumer Affairs is mandatory before engaging in credit counseling services.

The licensing process can be initiated by submitting a business license application in person or through the department’s online licensing system.

How Much is the Required Surety Bond for Credit Repair Businesses South Carolina?

One of the requirements for operating a credit repair business in South Carolina is obtaining a surety bond, which must be valued at a minimum of $25,000. This bond serves as protection for consumers against fraudulent practices. It is essential to procure the surety bond from a company authorized by South Carolina’s credit repair laws and maintain it for three years after license revocation, denial, or failure to renew.

Prohibited Acts Under Credit Repair Laws in South Carolina

1. Waiving a consumer’s right.

2. Charging consumers for entering debt management plans.

3. Providing services without a signed contract.

4. Making false representations about rates, terms, and conditions of credit repair services.

5. Soliciting purchases unrelated to credit repair. For instance, purchasing a stock, property, commodity, or service as part of the agreement.

6. Accepting payment for consumer referrals.

7. Disclosing consumer debt information to third parties.

8. Fraudulent representations.

9. Engaging in unfair or deceptive acts.

10. Collecting payments before completing services.

11. Unauthorized business operations at the licensed location.

Moreover, it is crucial to note that credit repair businesses in South Carolina should only claim to provide legal services if supervised by an attorney as required by state law. By adhering to these laws and regulations, credit repair professionals can operate legally and ethically while assisting South Carolina residents in improving their creditworthiness.

Contracts Under Credit Repair Laws in South Carolina

In South Carolina, credit repair companies, like in other states, must furnish consumers with a comprehensive written contract. This document must distinctly specify the services to be provided, the corresponding fees, and the agreed-upon duration of the arrangement.

Moreover, the contract must disclose the consumer’s rights to terminate the agreement within a stipulated timeframe. Additionally, it is crucial to note that credit repair entities operating in South Carolina are strictly forbidden from disseminating deceptive or inaccurate information about their services.

They are also prohibited from requesting upfront fees before delivering their services, ensuring that consumers are safe from potential financial exploitation. These regulations safeguard the interests of consumers seeking credit repair assistance in South Carolina.

** Disclaimer:

We aim to provide the most accurate information regarding South Carolina’s credit repair laws. However, please note that the laws may change anytime. We recommend doing more research for further information. Or consulting a lawyer about credit repair services law.

Abiding with credit repair laws in South Carolina is an important part of your success. Once you get all the licensing requirements to start a credit repair business in South Carolina, the next step will be finding the right credit repair software for your business to help you manage your clients easier and run your business smoothly.

PLANNING TO START OR EXPAND A CREDIT REPAIR BUSINESS? We Got You Covered!

Experience processing a client in less than 15 seconds with Credit Money Machine. It is the fastest credit repair software in the industry and the only software for fixing credit with CRM integrated, Sales program, Marketing program, and Credit Repair program with all areas working together to catapult the credit repair business to new heights.

We have 3 credit repair software for business to ensure you get what you need.

Alternatively, you can SCHEDULE A FREE LIVE PRESENTATION to see Credit Money Machine in action.

Read Credit Repair Laws in All States or navigate the map to read credit repair laws in other states.